Introduction

Venture capital is undergoing a seismic shift—one driven by data, AI, and real-time analytics. Traditional investment strategies, built on intuition and historical heuristics, no longer suffice in an era where speed and precision define success. The ability to harness predictive analytics not only enhances decision-making but also mitigates risk and accelerates due diligence.

Tech leaders in VC must evolve, leveraging AI, machine learning (ML), and data streaming technologies to drive smarter investments. This article explores how predictive analytics transforms venture capital and how platforms like Meroxa empower firms to seamlessly integrate real-time data pipelines for a competitive edge.

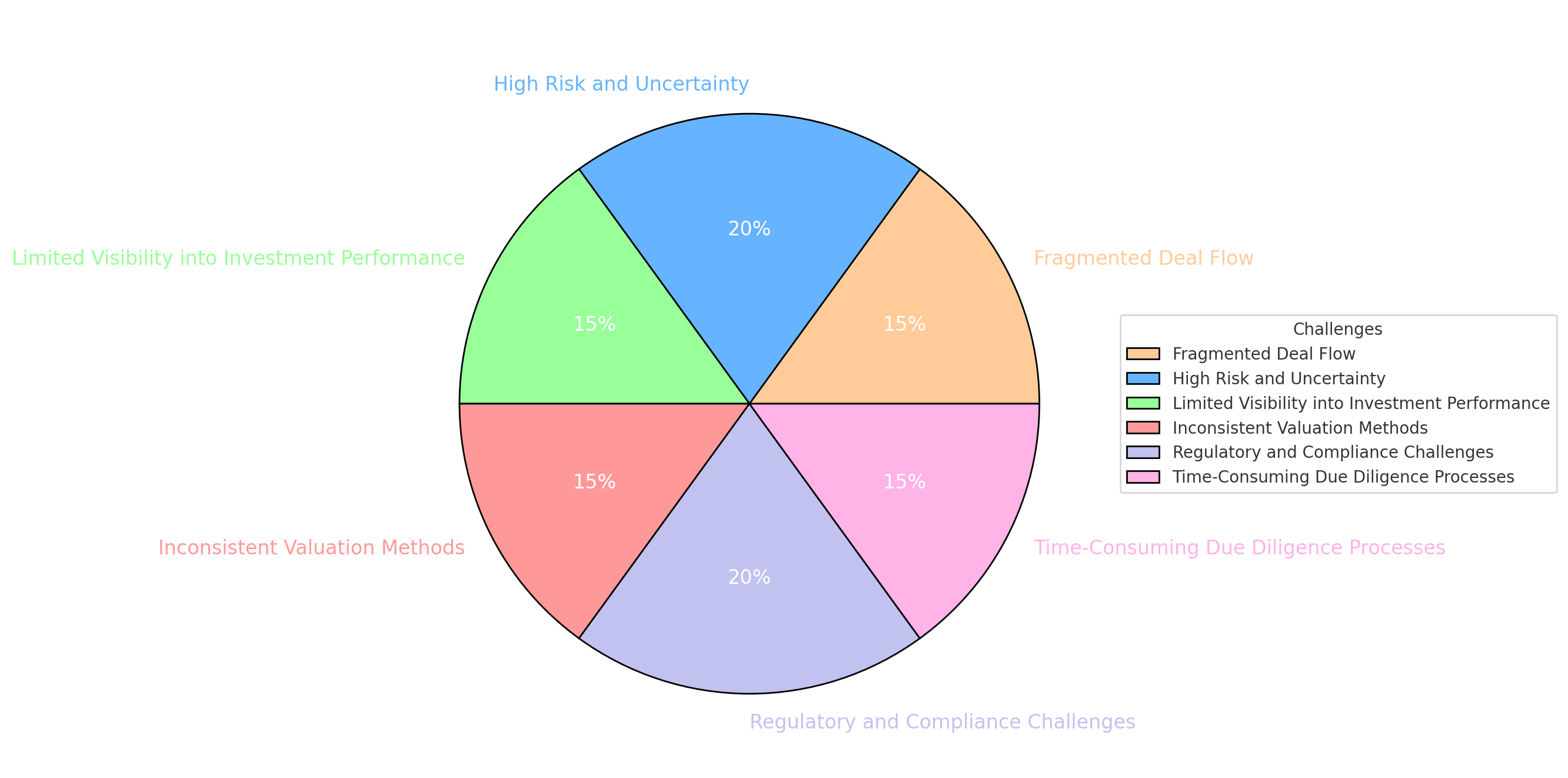

The Data Challenge in Venture Capital

Venture capital decision-making has long been constrained by fragmented, unstructured, and outdated data. The key challenges include:

- Data Overload: Investors must process vast volumes of financial reports, founder backgrounds, market intelligence, and unstructured sentiment data.

- Risk Mitigation: Identifying high-potential startups while filtering out high-risk ventures remains a complex task.

- Time-Intensive Due Diligence: Manual analysis of market signals and startup metrics delays decision-making, costing firms valuable opportunities.

Diagram: Illustrates the data fragmentation issues and challenges in VC.

Predictive analytics alleviates these challenges by structuring and interpreting complex datasets in real time, leading to faster, more accurate investment decisions.

The Predictive Analytics Pipeline in Venture Capital

A modern VC analytics pipeline integrates multiple data sources, applies machine learning models, and delivers actionable insights. Here’s how:

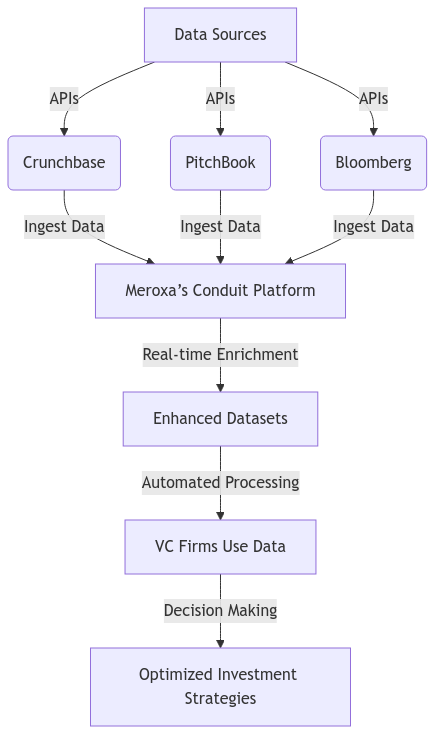

1. Real-Time Data Collection & Processing

Data is the foundation of predictive analytics, and VC firms must aggregate structured and unstructured data from diverse sources:

- Structured Data: Investment rounds, revenue metrics, market trends, SEC filings.

- Unstructured Data: Social media sentiment, press coverage, industry trends, founder digital footprints.

- Real-Time Feeds: Funding announcements, stock fluctuations, patent filings, hiring trends.

Diagram: Demonstrates data sources and ingestion mechanisms.

Meroxa’s Advantage: With Meroxa’s Conduit Platform, VC firms can automate data ingestion from APIs (e.g., Crunchbase, PitchBook, Bloomberg) and enrich datasets in real time, eliminating the bottlenecks of legacy ETL pipelines.

🔹 Key Technologies: Real-time data ingestion, event-driven architectures, Apache Kafka, Apache Flink.

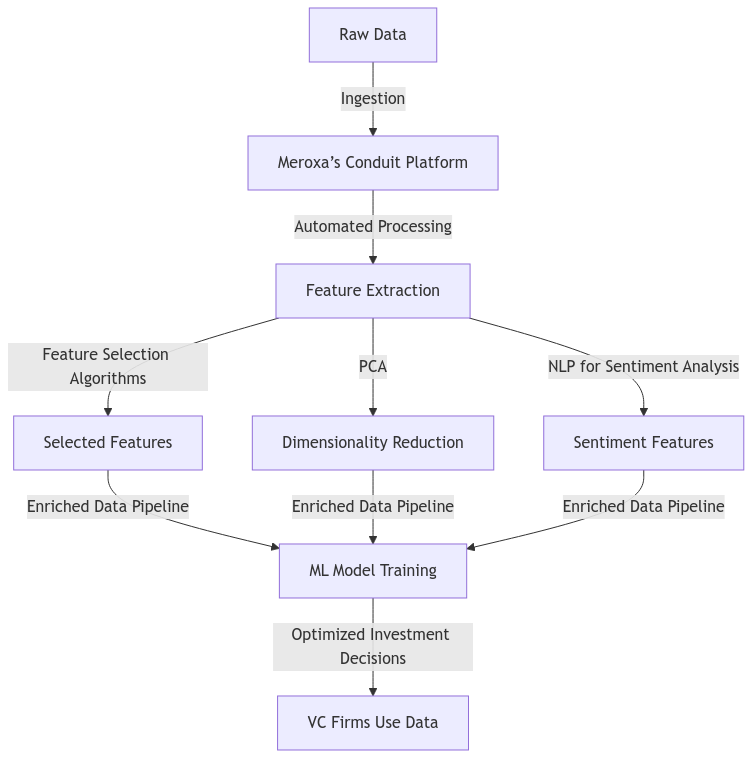

2. Feature Engineering & Data Modeling

Raw data must be transformed into structured insights to train predictive models effectively. Feature engineering is crucial in determining:

- Founder Signals: Prior exits, domain expertise, network strength, investor relationships.

- Market Traction: User adoption, revenue growth, customer acquisition costs (CAC).

- Competitive Landscape: Market positioning, barriers to entry.

- Macroeconomic Indicators: Interest rates, regulatory risks.

Diagram: Showcases the transformation of raw data into ML features.

Meroxa’s Advantage: Meroxa automates feature extraction and transformation, allowing VC firms to enrich data pipelines dynamically without complex ETL dependencies.

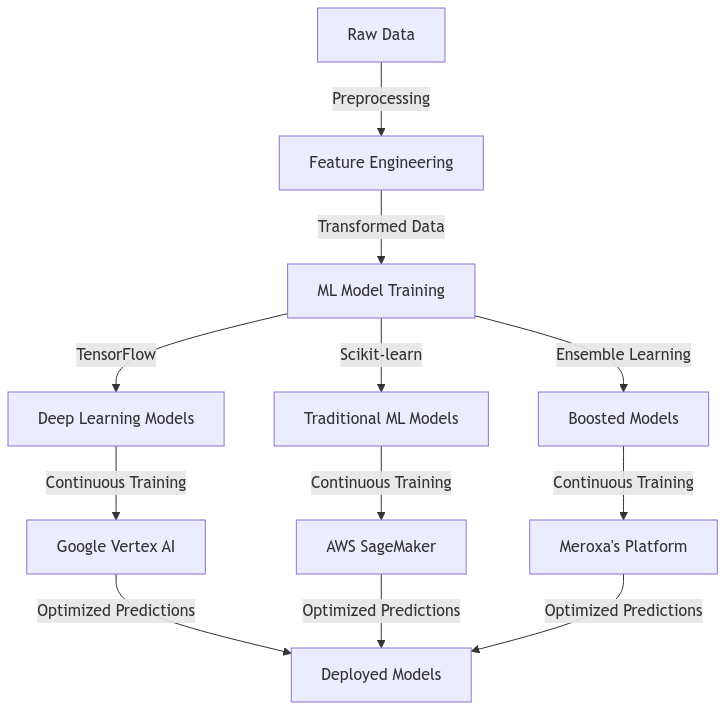

3. Machine Learning Model Training & Predictions

Once structured, data is fed into machine learning models to forecast startup success and optimize investment strategies:

- Classification Models: Logistic regression, random forests, neural networks for success/failure predictions.

- Regression Models: XGBoost, linear regression to forecast valuation growth.

- Clustering Algorithms: K-means, hierarchical clustering to segment startups by risk-return profiles.

Diagram: Depicts different ML models and how they are trained.

Meroxa’s Advantage: By seamlessly integrating with ML platforms like Google Vertex AI and AWS SageMaker, Meroxa enables continuous model training on real-time data.

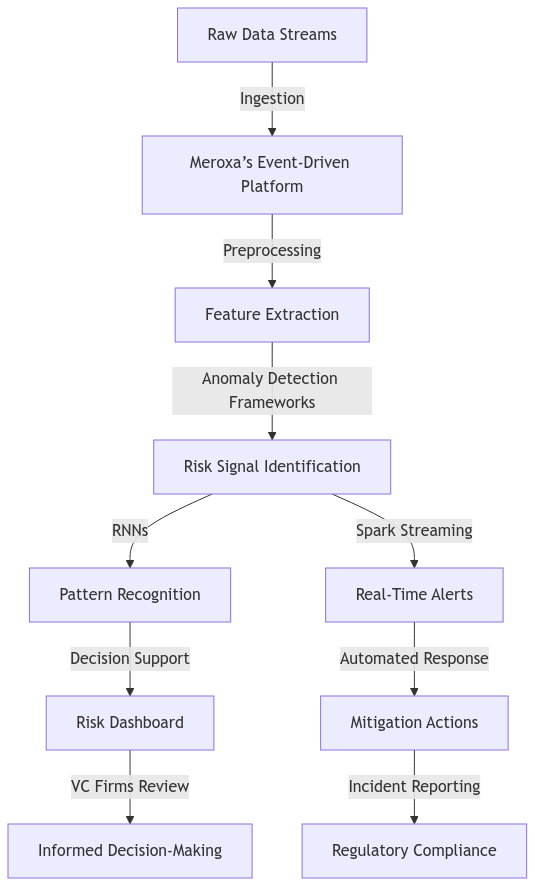

4. Real-Time Risk Analysis & Anomaly Detection

Predictive analytics extends beyond forecasting; it proactively identifies emerging risks:

- Sentiment Analysis: NLP models scan Twitter, news, and LinkedIn for sentiment trends.

- Anomaly Detection: AI flags inconsistencies in financial statements and funding patterns.

- Automated Alerts: AI-driven alerts notify investors of negative news trends, regulatory risks, or executive departures.

Diagram: Highlights the process of monitoring risk signals in real time.

Meroxa’s Advantage: Using event-driven architectures, Meroxa delivers real-time anomaly detection, ensuring VC firms act swiftly on emerging risks.

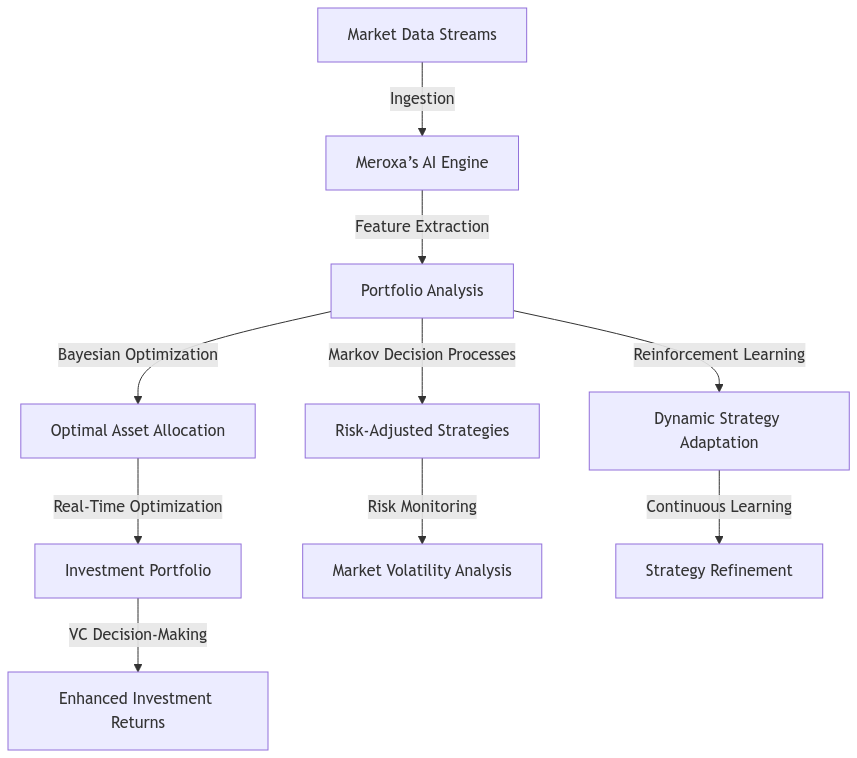

5. Portfolio Optimization & Dynamic Investment Strategy

Predictive analytics extends beyond startup selection to portfolio management:

- AI-Powered Capital Allocation: Optimizes fund distribution across growth stages.

- Scenario Simulation: Monte Carlo simulations test different economic conditions.

- Exit Strategy Forecasting: Predicts optimal IPO, acquisition, or secondary market exit timing.

Diagram: Illustrates AI-driven portfolio management strategies.

Meroxa’s Advantage: By integrating reinforcement learning models, Meroxa ensures investment strategies dynamically evolve based on new market conditions.

The Future of AI-Driven Venture Capital

As predictive analytics continues to evolve, we anticipate:

- Explainable AI (XAI): Reducing the black-box nature of VC funding models.

- Blockchain & Smart Contracts: Automating equity tracking and funding disbursement.

- Quantum Computing: Unlocking ultra-complex investment simulations for multi-factor startup evaluations.

Conclusion

VC firms must move beyond intuition-based decision-making and embrace AI-powered precision. Predictive analytics, when integrated with real-time data pipelines, unlocks unprecedented speed and accuracy in investment decisions.

Meroxa is the missing link for tech-driven VC firms, providing the infrastructure to build real-time, AI-powered investment intelligence. Check out a demo with one of our experts today! Also, follow us on Twitter, LinkedIn, and YouTube for more insights and updates!